FINERPOL 5th call lessons learnt

FINERPOL 5th call lessons learnt

FINERPOL aims to increase the renovation rate of buildings by improving access to finance and so enabling those upfront investments to be made.

Financial Instrument schemes with EU participation are created to provide finance on a complementary basis from the Union budget to address policy objectives of the Union. These objectives are often achieved with risky investments that require public participation to de-risk financing.

This EU financial support will be combined with finance coming from the private sector and other public financial sources in order to promote investments in the area of building energy retrofitting.

Such instruments may take the form loans or guarantees and other risk-sharing instruments (equities and quasi-equities), and may, where appropriate, be combined with grants.

Most common instrument in any financial scheme, have repayment priority over other financial structures such as equities, have low risk (but higher interest) and are easy to manage.

Most common instrument in any financial scheme, have repayment priority over other financial structures such as equities, have low risk (but higher interest) and are easy to manage.

An investor creates a guarantee in order to de-riskfinancing (loan or other) and offer cheaper financing, they require less funding than loans alone and have a clear multiplying effect.

An investor creates a guarantee in order to de-riskfinancing (loan or other) and offer cheaper financing, they require less funding than loans alone and have a clear multiplying effect.

As in the creation of a Company, an investor (also public entities) may contribute to financing contributing as a partner or shareholder, having higher risks but also higher ROI. It usually targets a smaller number of recipients with high investment volume.

As in the creation of a Company, an investor (also public entities) may contribute to financing contributing as a partner or shareholder, having higher risks but also higher ROI. It usually targets a smaller number of recipients with high investment volume.

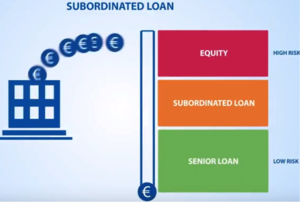

A type of financing that ranks between debt and equity according to the exposure to loss in case of insolvency or the level of ownership acquired. It stimulates risky investment with less collateral requirements than equities. A special case is the subordinated loan: It will only be paid back once the senior loans are entirely paid.

A type of financing that ranks between debt and equity according to the exposure to loss in case of insolvency or the level of ownership acquired. It stimulates risky investment with less collateral requirements than equities. A special case is the subordinated loan: It will only be paid back once the senior loans are entirely paid.

€2,010,730.00

Low-carbon economy

Buildings account for 40% of energy use and 36% of CO2 emissions in the European Union. Currently, about 35% of the EU's buildings are over 50 years old, and by improving their energy efficiency we could reduce total EU energy consumption by 5-6% and lower CO2 emissions by about 5%.

Increasing investment in energy efficiency and renewable energy for buildings is a major challenge, requiring substantial up-front investments (estimated at €38 billion during 2011-30).

The European Union provides support for the creation of funding instruments, especially Financial Instruments (FIs) supported by ERDF funds and integrated with EC funding initiatives, such as EFSI (Juncker Plan 06/2015), tools from the European Investment Bank EIB (ELENA, Margarite Funds) or from public and private partnerships.

FINERPOL 5th call lessons learnt

The 4th Interregional Event of the 5th Call FINERPOL Project was held in Extremadura on the 13-14th of September 2023 organised by Extremadura Energy Agency (AG

Plymouth City Council’s (PCC) and Devon County Council co-hosted their fellow partners from the FINERPOL and AGRORES projects for interregional event.

FINERPOL project held their 2nd Interregional Event of the 5th call, hosted by CTU UCEEB

FINERPOL Project Continues with Interregional Event in Prague, Sharing Knowledge in Implementing Financial Instruments during COVID-19 Pandemics

FINERPOL is one the projects of the fifth call for proposals of additional activities linked to COVID-19 activities launched by Interreg Europe.

After four years, the adventure of FINERPOL project ends with remarkable results.

Ana Martinez Pinilla from the FINERPOL project explains how financial instruments can help boost your region’s COVID-19 recovery.

Results of FINERPOL project will be disseminated in the annual event of Interreg Europe.

FINERPOL project ends and we present the main achievements of the project by participant region.