On March 29th about 35 stakeholders from the EU project Firespol came together for their second stakeholder meeting at the Hessian Ministry of Economics, Energy, Transport and Housing in Wiesbaden. This task force consists of over 25 organizations out of science, finance and supply industry, citizen energy cooperatives, project developer as well as from local and regional politics.

The discussions of the second stakeholder meeting will be held as a follow-up of the first meeting in November in Wiesbaden, Hessen. The stakeholders shared the opinion that the implementation of RES projects often fail because of a decreasing acceptance of local citizens and difficult frame conditions. Therefore, this meeting focused on finance mechanisms, which touch slightly on these obstacles already. That means, Good Practices with topics like regional or financial participation, local added value and local projects to support increased acceptance were picked out as central themes. Furthermore, we looked at the profitability of RES. Via higher profitability of RES projects some spaces for acceptance or regional added value measure can arise.

Christian Marcks / Community Bank GLS Gemeinschaftsbank opened the meeting with a short introduction into the finance sector of RES and considered similarly different finance instruments, visible trends and existing challenges within financing of RES.

In the following “Good Practices” from Hessen and Germany were presented which touch upon the mentioned challenges already. Sebastian Finck, Savings Bank Marburg-Biedenkopf showed one realized example with an interesting finance structure via a local savings bond. Alexander Koffka / ABO Wind reported about the financial model for citizens to participate in wind parks and the investment portfolio of ABO Invest. Afterwards crowd investing was highlighted by Dirk Völker, Director of GreenVesting GmbH using an example of the online crowd funding platform GreenVesting. As last resort Martin Kutschka from febis Service GmbH showed by an obvious example that a reasonable use of funding can achieve and increase the profitability of RES projects.

In the closing discussion the participants underlined that the presented financial instruments can’t be more than one element in supporting financing and implementation of RES projects. The public frame conditions must be considered in the same way as educational work for promotion of local acceptance.

In Summary can be said, that the described “Good Practices” are predestinated to overcome some of the local obstacles. Acceptance and risk minimization are key factors for a successful implementation of RES. However, networking between financiers and investors is essential in order to develop financing strategies.

The discussion also striped the new topic PPA (power purchase agreement). But this is not relevant for Hessen and Germany so far.

It became clear that other issues cannot be overcome by just using financial instruments or structure. There is a need of further measures and initiative on different levels. The stakeholders appreciate exchange with other players within the field of RES.

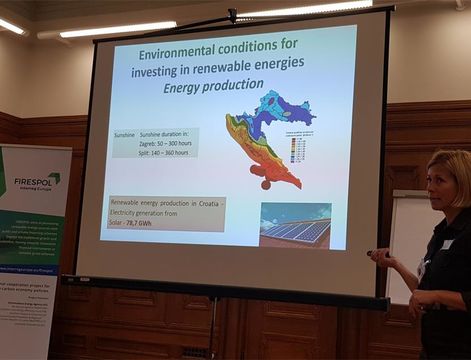

The results and experiences of the second stakeholder meeting will be shared with all five European partners of Firespol at the beginning of May in Croatia.