AFIN SGR's mission is to facilitate access to credit for SMEs. Our goal is to become the strategic partner of small and medium entrepreneurs, providing greater

The Valencian economy is basically made up of small businesses; 90% of them have less than 10 workers, with a weak capital and equity structure that hinders their growth and innovation processes. In this context, in the 80s of the last century, a new-born Valencia regional government promoted the birth of the SGR - the Reciprocal Guarantee Society of the Region of Valencia, as a way to facilitate access to the financial instruments of the companies of the region.

AFIN SGR's mission is to facilitate access to credit for SMEs. Our goal is to become the strategic partner of small and medium entrepreneurs, providing greater professionalization and knowledge of market opportunities in financing requests.

Our activity includes providing guarantees to the project, negotiating better financing conditions, and offering information and advice to solve financing needs.

Our goal is to become the strategic partner of the small business owner, providing more professionalization and knowledge of market opportunities in financing requests.

For this we have adapted (designed) our catalogue so that the applicant can easily identify the product according to their need.

Final recipients targeted SMEs and freelancers

Limits and deadlines:

- Investment with real guarantee: 15 years

- Investment without real guarantee: 10 years

- Maximum investment amount: € 750,000

Resources needed

Our partners are, on the one hand, the participating partners, whose subscribed capital is linked to the living risk we have with them, and on the other, the protective partners whose capital is free and not linked to the activity we carry out.

Evidence of success

AFIN SGR has more than 7,900 participating partners, whose projects we have supported.AFIN SGR has more than 7,900 participating partners, whose projects we have supported.

In 2019 AFIN SGR carried out 5,925 commercial actions that allowed it to contact 3,645 entrepreneurs, who submitted 1,325 applications for guarantees amounting to € 140 million. These efforts culminated in the formalization of 362 guarantees amounting to almost € 30 million, doubling the volume of concessions of 2018.

Difficulties encountered

The Valencian economy is basically made up of small businesses; 90% of them have less than 10 workers, with a weak capital and equity structure that hinders their growth and innovation processes.

Potential for learning or transfer

The RGS are an agile and efficient solution to promote SME credit. They allow:

- to reduce the cost of SME financing;

- to reduce the risk to credit institutions; and

- to maximise the efficiency of public contributions.

Strategic sectoral challenges

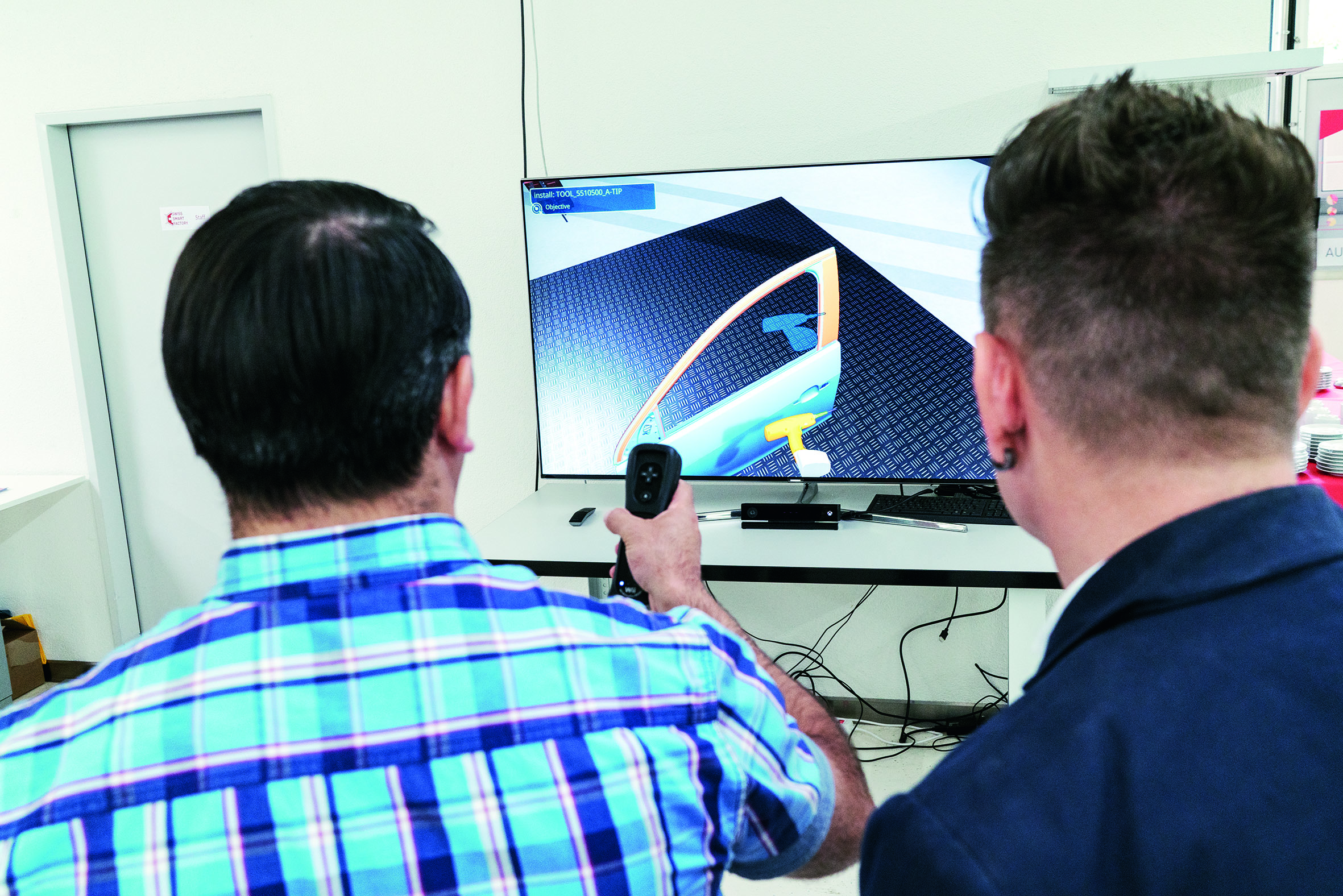

- Digitalisation

- New services/products and projects

- Institutional relations

- European relations

- Best practices (working groups)

The Guarantee System capillarity facilitates its access to SMEs and gives the possibility of stablishing a direct contact with enterprises of any region and sector. Moreover, the experience and high level of know-how that RGS have on SMEs and their environment mean an added value for financing institutions.

Tags: Funding, Innovation