For many, tax is understood as some kind of a nightmare.

What exactly that TAX is? It is defined as a mandatory financial charge or some other type of levy imposed upon a taxpayer (an individual or other legal entity) by a governmental organization in order to fund various public expenditures.

But we're not going to write about taxes now. What are we going to write about then?

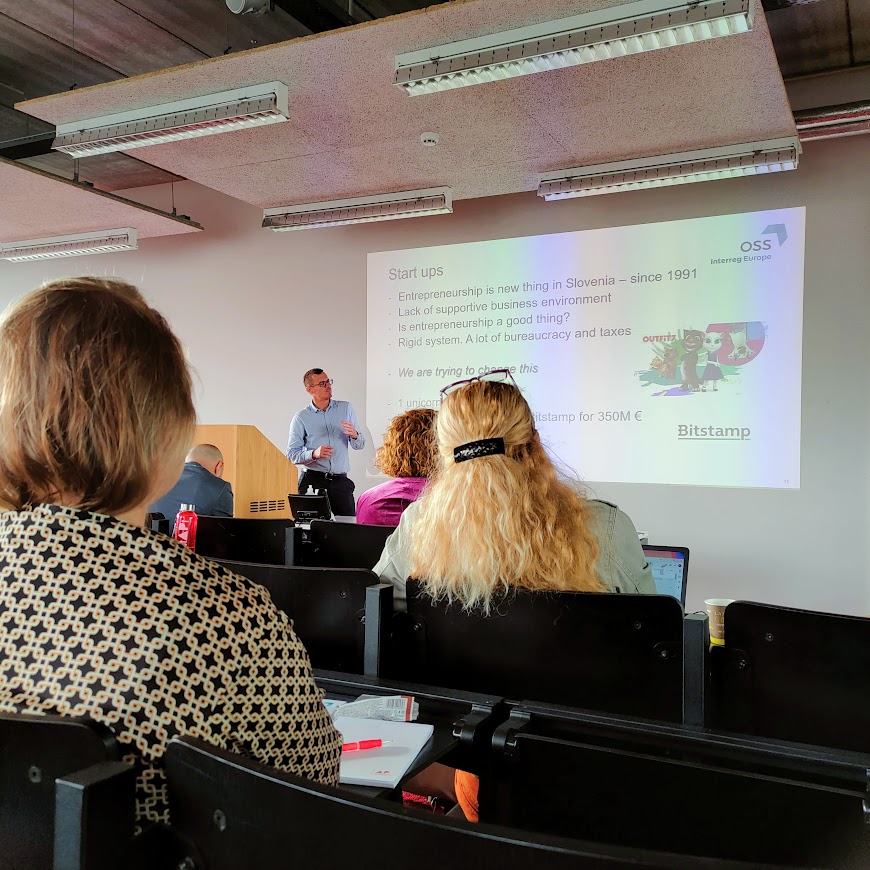

Let us present now, the other good practice that was presented by our Slovenian partner during our meeting in Hampshire - eDavki portal.

It is a state tax portal for individual users and legal entities. Tat portal enables convenient, easy and secure completion and submission of tax forms from the computer at home or the office. In addition to other tax forms, natural persons may submit their tax information returns for income tax assessment, as well as legal entities - their VAT forms (e.g. VAT-O) and VIES. Users may also use the electronic services of e-commerce taxpayer registration and the exchange of their information with tax administrations of other EU Member States, as well as the verification of tax numbers of taxpayers from all European Union countries.

All form fillings are made by using of eTax, that is a part of eDavki portal. eTax is a web service that taxable person can become its user. The application requires a computer with suitable software, Internet access and an appropriate digital certificate.The certificate contains basic user information (such as name, e-mail, unique id), certification authority information and most importantly, your public and private key. They are used to ensure safe communication over the internet. The certificate and private key are also used for signing submitted documents. Within The Law on Electronic Commerce and Digital Signature it has been recognized, that digital signature has equal validity as handwritten signature.

Sound interesting? Here you can find more info : bit.ly/2Y6eKAS